A System Under Strain

The safety net is increasingly under strain as growing inequality continues to drive up the numbers of people unable to meet their own basic needs.

|

| James Bryant picks up fresh produce from a mobile food pantry in New Haven. Read more about James's story. Photo Credit: United Way of Greater New Haven |

The Basic Needs Safety Net in an Age of Inequality

For millions of Americans, paying for food, housing and other necessities is a daily struggle. While many can turn to government safety-net programs, the benefits often fall far short of meeting their needs. Public assistance also excludes entire classes of people who do not qualify. Where government help ends, private charitable nonprofits step in to help fill the gaps. The result is a patchwork system that is increasingly under strain as growing inequality continues to drive up the numbers of people unable to meet their own basic needs.

The Numbers

- One in four New Haven residents lives at or below the federal poverty line¹ ($25,750 a year for a family of four).

- One in five New Haven residents experiences food insecurity.²

- More than 9,000 Connecticut residents experienced homelessness in 2018.³

- Nationally, of the top 15 occupations projected to add the most jobs over the next 10 years, only five pay annual wages higher than $37,690.4

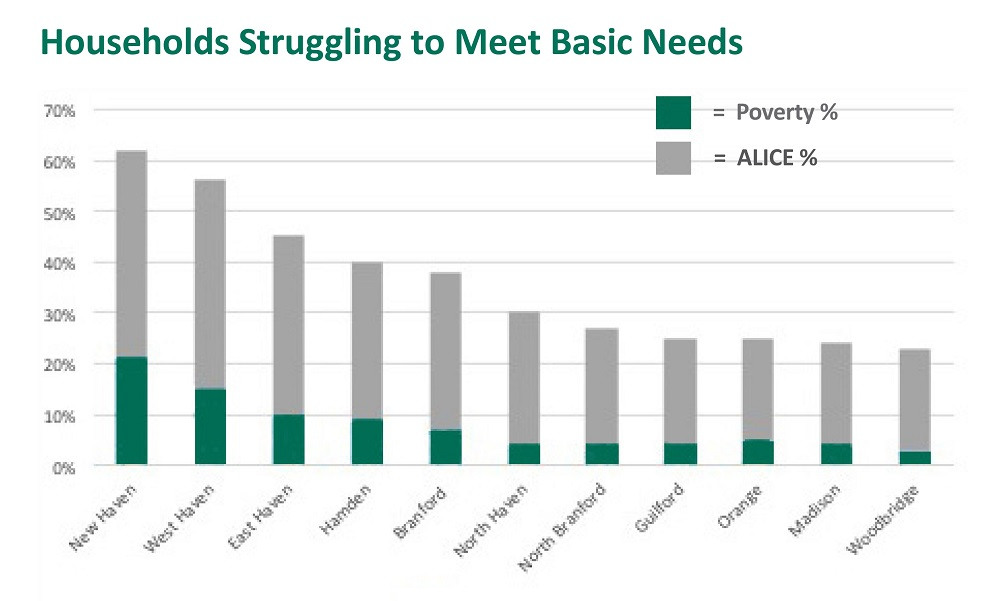

- Forty percent of Connecticut residents (66% in New Haven) earn less than they need to pay for food, housing, childcare and other basic daily necessities.5

The Patchwork "System" Straining at the Seams

Community-based nonprofit organizations including food pantries, shelters, housing agencies and health centers form the backbone of the basic needs delivery system. Most depend on a combination of government contracts and philanthropy to keep the lights on and doors open. Yet both sources of funding often fall short of covering the full cost of providing services or restrict how organizations can use the funding. The strains on this system are evident: nearly one in eight human services, community-based organizations are technically insolvent; more than 40 percent do not have enough cash on hand to meet their financial obligations.6

|

| The number of Connecticut households unable to afford life's basic necessities far exceeds the official federal poverty statistics. This demographic is known as ALICE, an acronym for Asset Limited, Income Constrained, Employed. The ALICE threshold is the average income that a household needs to afford the necessities. In Greater New Haven as of 2020, that is $29,148 for a single person and $90,732 for a family of four. |

What Does Philanthropy Contribute?

Americans gave more than $400 billion to charitable causes in 2017.7 When asked why they gave, most donors in the U.S. cited providing for people's basic needs as their top motivation, followed by helping the poor help themselves.8 Despite these charitable intentions, however, a look at where the tax-deductible donations actually go tells a different story.

A study by The Center of Philanthropy at Indiana University found most charitable gifts in the country support religion, education and health, while only one third of all charitable giving goes to provide basic needs to the poor.9The study also found that millionaires targeted more than half of their philanthropy to higher education and health and only four percent to basic needs; donors earning less than $100,000 devoted more than 10 percent of their giving to basic needs.10

Teach a Person to Fish vs. Giving the Fish

Many anti-poverty programs are designed around the premise that, in the words of the ancient proverb, "Give a man a fish and he will eat for the day. Teach a man to fish and he will eat for a lifetime." Yet one of the government's most powerful programs in lifting people out of poverty has been a wage subsidy in the form of the Earned Income Tax Credit (EITC). Providing an average of more than $3,000 per recipient, the EITC rewards employment and in 2016 was shown to have lifted 5.8 million people out of poverty.11 The program has also been associated with increased birth rates12 and student test scores.13

What the Community Foundation is Doing

The following funds are permanent sources of support for basic needs in Greater New Haven:

To learn more about establishing a fund to support basic needs, contact Dotty Weston-Murphy at The Community Foundation.

The funds above, along with others, as well as unrestricted dollars are used for grantmaking to organizations throughout Greater New Haven. Recent basic needs grants from The Foundation were made to the following organizations:

- Christian Community Action: to provide general operating support for food, shelter, housing, vocational training and advocacy programming for low-income residents in New Haven.

- Columbus House, Inc.: to provide general operating support to serve people who are homeless or at risk of becoming homeless.

- Connecticut Association for Human Services: to support the Family Economic Success suite of programs, including Volunteer Income Tax Assistance.

- Connecticut Food Bank: to support the Mobile Pantry program.

- Downtown Evening Soup Kitchen: to provide general operating support for free, nutritious meals.

- New Reach: to provide general operating support for shelter, housing, stabilization and furniture services for women and children.

Find Local Basic Needs Organizations

Sources

- "U.S. Census Bureau QuickFacts: New Haven City, Connecticut." Census Bureau QuickFacts. Accessed February 26, 2019. https://www.census.gov/quickfacts/newhavencityconnecticut.

- DataHaven 2018 Community WellBeing Survey. January 2019. Raw data. New Haven.

- CT Coalition to End Homelessness. January 2019. Raw Data.

- Loprest, Pamela, and Demetra Nightingale. The Nature of Work and the Social Safety Net. Report. Urban Institute. 2018. 10.

- "United Way of Greater New Haven." Connecticut ALICE.

- A National Imperative: Joining Forces to Strengthen Human Services in America - 2018. Report. Alliance for Strong Families and Communities. 31.

- Giving USA: The Annual Report on Philanthropy for the Year 2017 (2018). Chicago: Giving USA Foundation.

- Center on Philanthropy, Understanding Donor Motivations for Giving, New York: CCS.

- Center on Philanthropy, Patterns of Household Charitable Giving by Income Group, Indiana University.

- Ibid

- "Policy Basics: The Earned Income Tax Credit." Center on Budget and Policy Priorities. April 19, 2018.

- Hoynes, Hilary, Douglas Miller, and David Simon. "Income, the Earned Income Tax Credit, and Infant Health." American Economic Journal: Economic Policy, 2012.

- Chetty, Raj, John Friedman, and Jonah Rockoff. 14. New Evidence on the Long-term Impacts of Tax Credits. Report. Harvard University. 2011.