You’ve lived here. You’ve worked here. You are part of this community’s past and present. By creating a permanent fund with The Community Foundation, you have the opportunity to make a difference during your lifetime and, at the same time, provide for the community you care about for generations to come. As needs, opportunities and the nonprofits that address them change over time, your wishes are preserved and grants continue to make life better in the name of the fund you establish.

How it Works

- You make a gift of $10,000 to The Community Foundation - you can give cash, appreciated stocks, real estate, or other assets. Ask us about options for making gifts over time that add up to this minimum amount.

- We set up a special fund in your name, in the name of your family or business, or in honor of any person or organization you choose.

- You receive tax benefits in the year you make your gift.

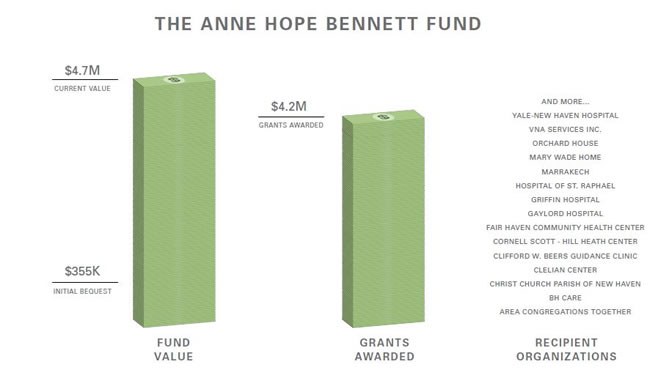

- The principle of your fund is never spent, and it can grow over time to generate an increasing stream of funding devoted to your interest areas and this community (see illustration below).

- We handle all the administrative details and issue grants to charities in the name of the fund you establish (if you prefer, grants can be made anonymously).

- Your gift is placed into an endowment – pooled with others to achieve maximum investment efficiency and return - that is invested over time. Earnings from your fund are used to make grants addressing community needs. Your gift - and all future earnings from your gift - is a permanent source of community capital, helping to do good work forever.

Most charitable gifts qualify for maximum tax advantages under federal law. Whether you choose to give today or give tomorrow through your estate, The Community Foundation's full range of fund options are flexible in their design to provide something for everyone.

Featured Fund

John D. Allen and Keith E. Hyatte for LGBTQ+ Interests Fund

During LGBT Pride Month (June) of 2019, New Haven Pride Center founder John D. Allen, Ed.D. & husband Keith Hyatte, director of Paint (ret.), Long Wharf Theatre, decided it was time that giving back to the LGBTQ+ community take on a new form — one that will provide a revenue stream long after their lifetimes.

The couple, who met in New Haven, established a donor advised fund at The Community Foundation for Greater New Haven so that LGBTQ+ interests will be advanced for generations to come.

"We’re at a point in our lives when we want to start thinking about a legacy and how to plan for our retirement and thereafter. We’re new to more formalized philanthropy. We never realized this was something that was open to us. That’s been exciting to realize; anybody can do it. We really feel a part of The Community Foundation family, and we want to help share that and make sure others feel the same."