Individuals who are 70 1/2 years old or older can donate up to $108,000 directly from a taxable IRA through a Qualified Charitable Distribution (QCD) to a charity like The Community Foundation. This may help you avoid being pushed into a higher tax bracket.

The Basics

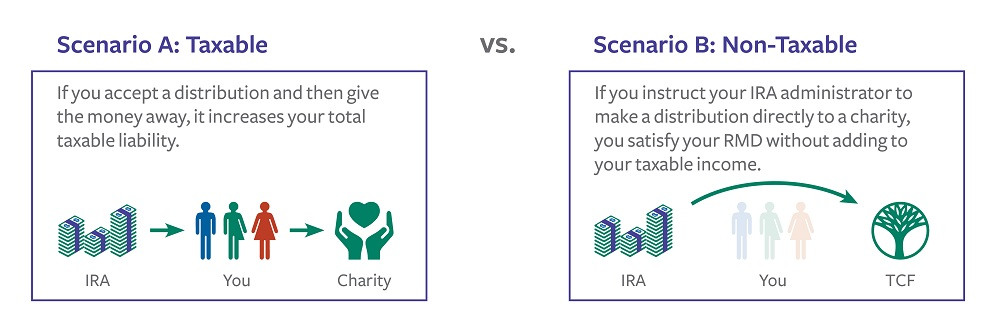

Since an IRA is a tax-deferred retirement account, contributions within stated limits are tax deductible, and appreciation and earnings are not taxed until they are withdrawn. When IRA owners reach age 73, they are required to take yearly minimum distributions —even if they don’t want or need the income. IRA distributions are taxed as ordinary income, which could mean pushing the tax payer in to a higher tax bracket. A one-step solution could be to request an IRA Qualified Charitable Distribution to a favorite charity because IRA Qualified Charitable Distributions are not taxable as income. The important part to remember is that the distribution must pass directly to the recipient charitable organization (see illustration below).

How an IRA Qualified Charitable Distribution Works

- Direct a transfer from your IRA account to The Community Foundation for Greater New Haven (or other eligible charity).

- Exclude the gift amount from your income for federal tax purposes.

- Count the gift toward your required minimum distribution for the year.

- Make an immediate impact in your community.

With your distribution, you can start an endowed, designated fund or add to an existing fund like the Community Now Fund at The Foundation, which enables you to recommend immediate grants to local nonprofits.

(Note: Donors are not permitted to direct gifts from a traditional IRA to a donor advised fund per IRS regulations; maximum distribution allowance is $108,000 per year).

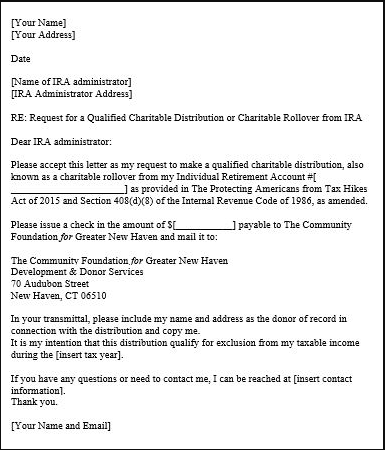

Ready to Notify your IRA Administrator?

It's easy when you use this sample Distribution Request Letter

[Your Name]

[Your Address]

Date

[Name of IRA administrator]

[IRA Administrator Address]

RE: Request for a Qualified Charitable Distribution or Charitable Rollover from IRA

Dear IRA administrator:

Please accept this letter as my request to make a qualified charitable distribution, also known as a charitable rollover from my Individual Retirement Account #[ ______________________] as provided in The Protecting Americans from Tax Hikes Act of 2015 and Section 408(d)(8) of the Internal Revenue Code of 1986, as amended.

Please issue a check in the amount of $[___________] payable to The Community Foundation for Greater New Haven and mail it to:

The Community Foundation for Greater New Haven

Development & Donor Services

70 Audubon Street

New Haven, CT 06510

In your transmittal, please include my name and address as the donor of record in connection with the distribution and copy me.

It is my intention that this distribution qualify for exclusion from my taxable income during the [insert tax year].

If you have any questions or need to contact me, I can be reached at [insert contact information].

Thank you.

[Your Name and Email]