How We Manage the Community’s Endowment

Investment Philosophy

The Community Foundation is an endowment organization designed to maintain the community’s charitable assets in perpetuity. Therefore, the investment management concepts and best practices contained within Connecticut law, such as the Uniform Prudent Management of Institutional Funds Act, and the Uniform Prudent Investors Act form the basis of our investment philosophy and strategy. Specifically: In order to preserve the purchasing power and real economic spending of the endowment, The Corporation shall manage its assets in the Perpetual Fund in accordance with a total-return approach, which does not distinguish between an asset’s yield and appreciation, but rather on the total expected return of the assets over the long-term. The Corporation includes those funds held by The Community Foundation’s affiliated entity, The Valley Community Foundation.

Investment Commentary: Q4 2025

The Community Foundation’s Corporate Commingled Fund posted a quarterly net return of 2.9% in the fourth quarter, which was roughly in line with its Policy Benchmark. Global markets ended 2025 on a strong footing despite early-year volatility driven by tariffs and trade policy uncertainty. U.S. equities advanced about 18%, supported by optimism surrounding artificial intelligence and the Federal Reserve’s decision to resume its easing cycle with 75 basis points of rate cuts. While valuations remain elevated, robust earnings growth, particularly among AI-driven companies, helped justify premium pricing. READ MORE

Partner With Us

The Community Foundation offers several investment options, depending on the type of fund.

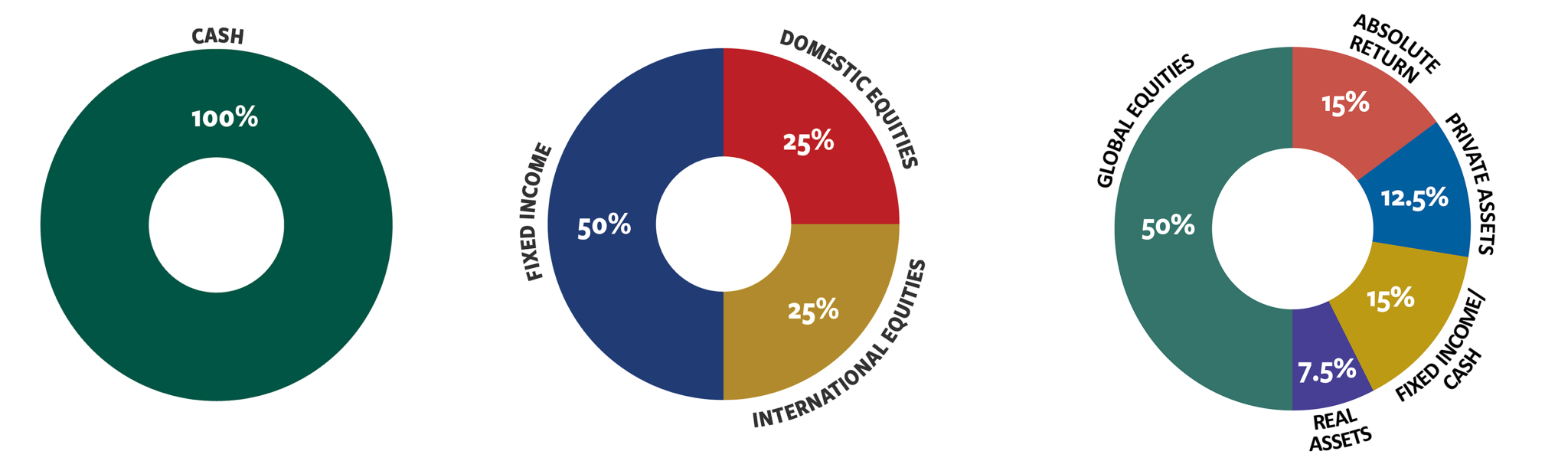

CashWith the Cash option, your donor advised fund is held in cash or cash equivalents to preserve capital, and is readily available for grantmaking at all times. | Intermediate FundThe Intermediate Fund is a diversified portfolio of liquid and public assets to provide the opportunity for modest appreciation with moderate risk. Assets are readily available for grantmaking at all times. This option is only available to donor advised funds. | Perpetual FundThe Perpetual Fund seeks to preserve the real economic spending power of your fund over time. To meet this objective, only a percentage (%) of your fund's market value is available to recommend for grantmaking each year. |

Organization Funds

Organization funds are charitable assets owned and controlled by individual nonprofits managed according to a long-term investment model established for The Community Foundation for Greater New Haven, Inc.’s (The Corporation) own endowment. A charitable organization can participate in this Commingled Fund by entering into an investment management agreement.

Organizations have the comfort of knowing that their endowment-like assets are managed according to the highest industry standards and best practices. Additionally, The Corporation is a registered investment adviser under the Connecticut Uniform Securities Act. As a registered investment adviser, The Corporation is regulated by The State of Connecticut’s Department of Banking and adheres to its comprehensive compliance program. More about organization funds.

The Spending Rule Policy

The Spending Rule Policy is designed to prudently release a predictable stream of revenue during each fiscal year to meet the region’s charitable needs, while at the same time allowing for maximum flexibility and efficiency of the investment management process.

Generally, and in the absence of a nonprofit institution’s right to withdraw principal from its organization fund, the process for extracting financial resources from endowment funds to meet the charitable needs of our community is accomplished through a Spending Rule Policy, which is defined as follows:

A Spending Rate, which is determined annually by The Community Foundation's Board of Directors, equal to the greater of: a) Fixed percentage1 of the endowment assets available for investment based on a trailing five-year moving average; or b) Four and One-Quarter Percent (4.25%) (the “Floor”) of the market valuation of the endowment assets at the end of the most recent calendar quarter; provided however in no event shall The Community Foundation spend more than Five and Three Quarters' Percent (5.75%) (the “Cap”) of the market valuation of the endowment at the end of the most recent calendar quarter.

1 The Spending Rate for 2025 is equal to five and one-half percent (5.5%).

With the cash option, a fund held in cash or cash-equivalent to preserve capital and is readily available for grantmaking at all times.

Investment Management Expense

The Corporation is a Connecticut registered investment adviser, and presents all investment performance information “net of expenses.” Net of expenses means net of the direct costs incurred in the operation of the Commingled Fund that holds the proprietary and organization funds’ endowment and endowment-like assets.

The Foundation’s FY24 (ending December 31st) externally-audited cost of the Commingled Fund's expenses, including sub-advisory fees, was seventy-seven basis points, or 0.77, and allocated to every component and organization fund on a pro-rata basis.

Administrative Fees

Administrative fees empower The Community Foundation to enhance the impact of philanthropy in Greater New Haven, drive community leadership and offer personalized service and local expertise. The following chart indicates the administrative fees for component funds administered by The Community Foundation:

| Type of Fund | Minimum Fund Balance* | Administrative Fees |

|---|---|---|

Unrestricted, Preference & Designated |

$10,000 |

1% annually of a fund's market value withdrawn quarterly |

Donor Advised |

$10,000 |

1% annually of a fund's market value withdrawn quarterly; for funds under $10,000, a minimum fee of $75 per quarter will apply unless the fund fits criteria of a Build-A-Fund |

Scholarship |

$25,000 |

If the scholarship requires application and review process, 1.5% annually of a fund's market value withdrawn quarterly; if a scholarship is designated to a single organization, then the designated fund minimum ($10,000) and fees apply (1%) |

* Funds can be built to fund-minimum in recommended period of 3-5 years or other time period per written fund agreement. Administrative fees will not be assessed during the "building" period.

Gifts by credit card: The fund that receives a credit card gift will incur the transaction fee assessed by the credit card processing company; this fee does not reduce the deductibility of the contribution.

Investment Performance

Each document below presents the investment performance of The Corporation, including those endowments and funds managed for the Valley Community Foundation, as independently reported by Brown Advisory.

Investment Performance - Corporation and Asset Summary - December 2025

Investment Performance - Trustees - December 2025

Investment Performance - Intermediate Fund - December 2025

Investment Performance - Corporation and Asset Summary - November 2025

Investment Performance - Corporation and Asset Summary - October 2025

Investment Performance - Corporation and Asset Summary - September 2025

Investment Performance - Corporation and Asset Summary - August 2025

Investment Performance - Intermediate Fund - September 2025

Investment Performance - Corporation and Asset Summary - July 2025

Investment Performance - Corporation and Asset Summary - June 2025

Investment Performance - Intermediate Fund - June 2025

Investment Performance - Corporation and Asset Summary - May 2025

Investment Performance - Corporation and Asset Summary - April 2025

Investment Performance - Corporation and Asset Summary - March 2025

Investment Performance - Trustees - March 2025

Investment Performance - Intermediate Fund - March 2025

Investment Performance - Corporation and Asset Summary - February 2025

Investment Performance - Corporation and Asset Summary - January 2025

Investment Performance - Corporation and Asset Summary - December 2024

Investment Performance - Trustees - December 2024

Investment Performance - Intermediate Fund - December 2024

Investment Performance - Corporation and Asset Summary - November 2024

Investment Performance - Corporation and Asset Summary - October 2024

Investment Performance - Corporation and Asset Summary - September 2024

Investment Performance - Trustees - September 2024

Investment Performance - Intermediate Fund - September 2024

Investment Performance - Corporation and Asset Summary - August 2024

Investment Performance - Trustees - August 2024

Investment Performance - Corporation and Asset Summary - July 2024

Investment Performance - Trustees - July 2024

Investment Performance - Corporation and Asset Summary - June 2024

Investment Performance - Trustees - June 2024

Investment Performance - Intermediate Fund - June 2024

Investment Performance - Corporation and Asset Summary - May 2024

Investment Performance - Trustees - May 2024

Investment Performance - Corporation and Asset Summary - April 2024

Investment Performance - Trustees - April 2024

Investment Performance - Corporation and Asset Summary - March 2024

Investment Performance - Trustees - March 2024

Investment Performance - Intermediate Fund - March 2024

Investment Performance - Corporation and Asset Summary - February 2024

Investment Performance - Trustees - February 2024

Investment Performance - Corporation and Asset Summary - January 2024

Investment Performance - Corporation and Asset Summary - December 2023

Investment Performance - Trustees - December 2023

Investment Performance - Intermediate Fund - December 2023

Investment Performance - Corporation and Asset Summary - November 2023

Investment Performance - Trustees - November 2023

Investment Performance - Corporation and Asset Summary - October 2023

Investment Performance - Trustees - October 2023

Investment Performance - Corporation and Asset Summary - September 2023

Investment Performance - Trustees - September 2023

Investment Performance - Intermediate Fund - September 2023

Investment Performance - Corporation and Asset Summary - August 2023

Investment Performance - Trustees - August 2023

Investment Performance - Corporation and Asset Summary - July 2023

Investment Performance - Trustees - July 2023

Investment Performance - Corporation and Asset Summary - June 2023

Investment Performance - Trustees - June 2023

Investment Performance - Intermediate Fund - June 2023

Investment Performance - Corporation and Asset Summary - May 2023

Investment Performance - Trustees - May 2023

Investment Performance - Corporation and Asset Summary - April 2023

Investment Performance - Trustees - April 2023

Investment Performance - Corporation and Asset Summary - March 2023

Investment Performance - Trustees - March 2023

Investment Performance - Intermediate Fund - March 2023

Investment Performance - Corporation and Asset Summary - February 2023

Investment Performance - Trustees - February 2023

Investment Performance - Corporation and Asset Summary - January 2023

- Investment Performance - Corporation and Asset Summary - December 2022

- Investment Performance - Trustees - December 2022

- Investment Performance - Intermediate Fund - December 2022

- Investment Performance - Corporation and Asset Summary - November 2022

- Investment Performance - Trustees - November 2022

- Investment Performance - Corporation and Asset Summary - October 2022

- Investment Performance - Trustees - October 2022

- Investment Performance - Corporation and Asset Summary - September 2022

- Investment Performance - Trustees - September 2022

- Investment Performance - Intermediate Fund - September 2022

- Investment Performance - Corporation and Asset Summary - August 2022

- Investment Performance - Trustees - August 2022

- Investment Performance - Corporation and Asset Summary - July 2022

- Investment Performance - Trustees - July 2022

- Investment Performance - Corporation and Asset Summary - June 2022

- Investment Performance - Trustees - June 2022

- Investment Performance - Intermediate Fund - June 2022

- Investment Performance - Corporation and Asset Summary - May 2022

- Investment Performance - Trustees - May 2022

- Investment Performance - Corporation and Asset Summary - April 2022

- Investment Performance - Trustees - April 2022

- Investment Performance - Corporation and Asset Summary - March 2022

- Investment Performance - Trustees - March 2022

- Investment Performance - Intermediate Fund - March 2022

- Investment Performance - Corporation and Asset Summary - February 2022

- Investment Performance - Trustees - February 2022

- Investment Performance - Corporation and Asset Summary - January 2022

- Investment Performance - Trustees - January 2022

- Investment Performance - Corporation and Asset Summary - December 2021

- Investment Performance - Trustees - December 2021

- Investment Performance - Intermediate Fund - December 2021

- Investment Performance - Corporation and Asset Summary - November 2021

- Investment Performance - Trustees - November 2021

- Investment Performance - Corporation and Asset Summary - October 2021

- Investment Performance - Trustees - October 2021

- Investment Performance - Corporation and Asset Summary - September 2021

- Investment Performance - Trustees - September 2021

- Investment Performance - Corporation and Asset Summary - Aug 2021

- Investment Performance - Trustees - Aug 2021

- Investment Performance - Corporation and Asset Summary - July 2021

- Investment Performance - Trustees - July 2021

- Investment Performance - Corporation and Asset Summary - June 2021

- Investment Performance - Trustees - June 2021

- Investment Performance - Intermediate Fund - June 2021

- Investment Performance - Corporation and Asset Summary - May 2021

- Investment Performance - Trustees - May 2021

- Investment Performance - Corporation and Asset Summary - April 2021

- Investment Performance - Trustees - April 2021

- Investment Performance - Corporation and Asset Summary - March 2021

- Investment Performance - Trustees - March 2021

- Investment Performance - Intermediate Fund - March 2021

- Investment Performance - Corporation and Asset Summary - February 2021

- Investment Performance - Trustees - February 2021

- Investment Performance - Corporation and Asset Summary - January 2021

- Investment Performance - Trustees - January 2021

- Investment Performance - Corporation and Asset Summary - December 2020

- Investment Performance - Trustees - December 2020

- Investment Performance - Intermediate Fund - December 2020

- Investment Performance - Corporation and Asset Summary - November 2020

- Investment Performance - Trustees - November 2020

- Investment Performance - Corporation and Asset Summary - October 2020

- Investment Performance - Trustees - October 2020

- Investment Performance - Corporation and Asset Summary - September 2020

- Investment Performance - Trustees - September 2020

- Investment Performance - Intermediate Fund - September 2020

- Investment Performance - Corporation and Asset Summary - August 2020

- Investment Performance - Trustees - August 2020

- Investment Performance - Corporation and Asset Summary - July 2020

- Investment Performance - Trustees - July 2020

- Investment Performance - Corporation and Asset Summary - June 2020

- Investment Performance - Trustees - June 2020

- Investment Performance - Intermediate Fund - June 2020

- Investment Performance - Corporation and Asset Summary - May 2020

- Investment Performance - Trustees - May 2020

- Investment Performance - Corporation and Asset Summary - April 2020

- Investment Performance - Trustees - April 2020

- Investment Performance - Corporation and Asset Summary - March 2020

- Investment Performance - Trustees - March 2020

- Investment Performance - Intermediate Fund - March 2020

- Investment Performance - Corporation and Asset Summary - February 2020

- Investment Performance - Trustees - February 2020

- Investment Performance - Corporation and Asset Summary - January 2020

- Investment Performance - Trustees - January 2020

Benchmarks & Assessment Process

The Corporation and The Community Foundation measure and assess its investment performance monthly, both manager-by-manager and cumulatively, through an external third party. All investment performance data, including holdings and transactions, is independently provided by each manager to The Community Foundation’s independent auditor and to Brown Advisory. Investment performance for the Perpetual Fund is assessed against two benchmarks, as follows:

The Policy Benchmark is the Policy Benchmark and equal to the rate of return produced by specific market indices representing the asset classes contained in the long-term asset allocation model (11odel), with such market indices weighted in accordance with that Model. The market benchmark for the Model is: 50% MSCI All Country World Index; 15% HFRI Fund of Funds; 12.5% S&P 500 + 3%; 7.5% CPI plus 5%; and 15% Bloomberg US Aggregate.

The Passive Benchmark is equal to a seventy percent (70%) allocation to MSCI AC World Index and a thirty percent (30%) allocation to the Bloomberg US Aggregate.

Governance of Investment Process

The Community Foundation’s Board of Directors annually appoints an Investment Committee consisting of up to eight (8) members, not necessarily from its own membership, which shall be responsible for complete oversight and implementation of the strategies, models and managers for the investment of the charitable assets entrusted to The Corporation. In concert with the professional staff, the Investment Committee may engage consultants as necessary or desirable to discharge its duties, and shall report such results, activities and actions to the Board of Directors, the donors and the general public via The Community Foundation’s website, at regular intervals.

Currently, the Investment Committee consists of three (3) current members of The Community Foundation’s Board of Directors and up to four (4) independent investment experts.