Monitoring Our Investments During the COVID-19 Crisis

This update summarizes our views of current market conditions, and our strategy for allocating the Foundation’s long-term assets.

Market Conditions and Stewardship of Assets

April 27, 2020: Our world is in the midst of an extraordinarily difficult time that combines a significant threat to the health and economic well-being, and presents challenges to distribute even more resources to support our community through this current pandemic while preserving our ability to provide support for future needs and community opportunities.

During the month of March, The Community Foundation experienced a net investment loss of approximately (12.6%), and for the year-to-date period ended March 31st, the net return was approximately (16.3%) and is currently lagging its market benchmark as a result the circumstances described below.

The Community Foundation for Greater New Haven has long pursued a strategy that is built on balance, diversification and a high level of liquidity. This allows us to fund current needs while also prudently capitalizing on the extraordinary long-term opportunities that are created during times of great upheaval.

This update summarizes our views of current market conditions, and our strategy for allocating the Foundation’s long-term assets.

Market Conditions

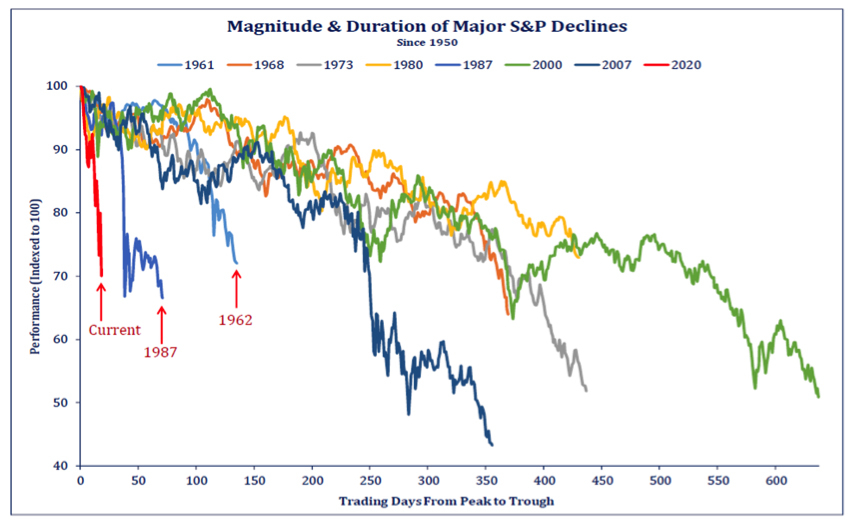

Source: Strategas Research Partners

This chart was produced as of March 17, 2020 and reflects the largest equity market declines since 1950. While we are not currently experiencing the largest decline in terms of magnitude, it has been the most rapid. In our view, there are a number of factors worth considering:

- There is now an extremely wide range of near term economic/business outcomes, and market volatility and downward pressure are entirely logical from this perspective.

- Changes in market structure, in particular the dominance of computer driven trading, a reduction in the significance of fundamental active management, and other factors, which is contributing to substantial volatility and extraordinary levels of mispricing even when considering a highly pessimistic outlook for business conditions.

- We are seeing a reaction from the active management investment community where highly capable and previously inaccessible firms are accepting capital, and in some cases for the first time in years.

- Market panics are highly charged climates and with the combination of threats to health of our citizens, a severe economic contraction, and increasingly unstable capital markets are a recipe for prices that reflect economic outcomes that have virtually no chance of occurring. This is where massively outsized and asymmetric opportunities for rigorous and patient long-term investors are born.

Portfolio Strategy and Stewardship of Assets

While the observable facts and the global battle against COVID-19 are tragic, daunting and unprecedented, we believe that the essential perspective regarding the importance of remaining committed to achieving long-term outcomes is paramount. We also believe that it is important to consider scenarios where the impact of COVID-19 lasts for as long as 24 months. This is not a reference to a continuing shutdown of our economy but rather the idea that there will be continuing adverse implications related to both the disease and the required steps to stop its transmission. The implications of the more negative scenarios are as follows:

- Exposure to investments where balance sheets are vulnerable, survival depends on access to the capital markets or on a rapid return to normal economic conditions, should be approached with great caution.

- The dysfunction of markets tends to significantly reduce the expected benefits of portfolio diversification. The Community Foundation will continue to have sufficient access to cash in order to fund the community’s needs as we go through this difficult period.

- Assuming equity portfolios are constructed with the potential for an extended period of economic impact, we currently see a wide array of investments that are trading with exceptional asymmetry. This is a reference to exceptionally large expected returns in the base case and compelling returns in downside scenarios. It is for this reason that The Foundation intends to maintain its pre-crisis equity targets.

This leads to an approach that is somewhat similar to that which The Foundation pursued during the 2007-09 Global Financial Crisis. The Foundation in conjunction with our external investment advisor, Colonial Consulting, have been actively pursuing the following:

- Connecting and monitoring of every manager, including a focus on all portfolio actions, written reports and analyses, and direct communications, and in each interaction, looking for calm and thoughtful behaviors.

- Studying the managers’ underlying portfolios for allocations compared to stated policy. Colonial has a comprehensive system and information management infrastructure that allows performance assessments daily. Under normal conditions, this information is used to assess the degree of long-term thinking of managers and risk factors in the portfolio. Presently, it is also being used to determine portfolio exposures for the purpose of informing The Foundation when it would be advisable to redeploy capital based on market opportunities.

- Communicating with exceptional and generally inaccessible managers with the goal of obtaining capacity that can be used to further enhance the portfolio. The Foundation continues to benefit from the use of this strategy just over ten years ago in the Global Financial Crisis.

In the face of this horrendous world crisis, we are even more focused on the fundamental ideas of discipline, balance, diversification and a risk-aware but opportunistic view that have long been tenets of the Foundation’s strategy. We are confident in their ability to serve us well once again, and will continue to provide updates and analyses to our community over the coming weeks.

As the situation of COVID-19 change day by day, The Community Foundation is monitoring the performance of the community's endowment which like all economic activity and world markets is experiencing declines.

In consultation with our independent advisers from Colonial Consulting, we offer a few observations about the markets, our investment performance, and strategy:

While the performance of our portfolio is down, it is ahead of market benchmarks.

- The Foundation's return through mid-March is down overall approximately 18.8% as compared to the world equity markets' loss of approximately 29%.

- The Community Foundation’s current portfolio has several valuable characteristics to help aid against the market volatility. First, it is well diversified and has a meaningful allocation to hedge funds and high quality bonds, which aids tremendously with the required liquidity to meet our financial obligations to the community without having to sell assets stocks into a panic or for prices that are not reflective of underlying value. Second, the framework and structure of the endowment has a fundamental premise for hiring managers that have differentiated models for investing in strong businesses that are reasonably proced, well-managed and able to weather economic storms.

Given the way things are evolving, most managers are starting to discuss if we are headed into a recession.

- For quite some time, (most recently due to plunging oil prices and COVID-19), we have noticed that prices have been moving in one direction (price momentum) with little regard for the fundamental value of investments. This seems to be at least partially related to the degree to which computers now dominate daily trading. While this crisis in unprecedented, the Foundation has weathered these storms in the past and is committed to doing so with our community again now.

We are and remain a long term investor.

- The Community Foundation doesn't try to time the markets and has confidence in our approach and the managers, which have proven and demonstrated track record under economic conditions.

- As a steward of the communities’ perpetual charitable capital, The Foundation sees the longer time frames as being far more likely to reflect the quality of an investment, and is positioned in the short to intermediate term to re-balance for the creation of that longer term opportunity.

- Prices can quickly drop, as they have been, but they can just as quickly go higher. The important point that guides our decisions is that capital markets are cyclical and as we have witnessed lately, subject to reversals in fortune which can be quite sudden and powerful.

- We will continue to be your diligent and patient endowment partner, and look forward to providing updates on a periodic basis as this crisis unfolds.