Market Commentary and Investment Summary: Q3 2022

The global markets declined in the third quarter as inflation remained at its elevated levels, the Federal Reserve continued to aggressively increase interest rates, and geopolitical tensions remained top of mind.

The Corporation’s Commingled Investment Fund produced net of fee return for the 3Q of (3.2%) outpacing the market benchmark’s return of (4.4%.) On a YTD basis, the Corporation is ahead of its benchmark by 100 basis points, posting a net return of (16.8%) versus the market benchmark of (17.8%). The portfolio’s diversification, to weather different economic scenarios, was benefited by meaningful exposure to inflation protected securities and to real assets.

The global markets declined in the 3Q as inflation remained at its elevated levels, the Federal Reserve continued to aggressively increase interest rates, and geopolitical tensions remained top of mind. Evidence continues to point towards a significant economic downturn, as the global purchasing managers’ index is suggesting slowdowns in many key regions. Volatility also picked up as market participants adjusted their views to incorporate meaningful recessionary fears given a very determined Federal Reserve and the surging US dollar. In the UK, the Bank of England has already pivoted from quantitative tightening to quantitative easing, as a rapid escalation in the cost of living and political turmoil has taken hold.

More specifically:

- The Corporation outperformed the market benchmark by 100 basis points during the month of September with a (4.9%) versus (5.9%).

- September’s net global equity performance was (7.7%) or 190 basis points better than the MSCI ACWI’s (our benchmark for this asset class) return of (9.6%). Most of the outperformance came from Tenzing (3.3%) and Cevian (5.6%), while Barker’s concentrated strategy was off 11.3%.

- Tenzing’s results were bolstered by Yelp’s performance, their second largest position, which was “flat” for the month as advertisers’ demand continues to look strong.

- Cevian’s portfolio fell less then index (-5.6% vs -6.0%), and for the year is down (11.8%) versus (17.2%) for the MSCI Europe, as its focus on industrial and materials companies were helpful.

- Barker’s position in ASOS, which made up 40% of their portfolio a year ago, continues to struggle as supply chain issues and management changes have taken place. ASOS is down 80% year-to-date and fell -23.2% in September alone.

- The Hedge Fund allocation of the long-term model was off (2.2%) versus (2.0%) for the HFRI Fund of Funds and (4.6%) for the HFRI Equity Hedge Index, with Nitorum adding return vis-à-vis the index and Bayberry falling the most (4.4%) during the month

- Nitorum generated alpha on the long side as stocks like Churchill Downs and many of their healthcare stocks outperformed the market.

- Bayberry lost ground as JBI, the manufacturer of rolled steel doors for self-storage units lost (13.4%) as demand slowed and inflationary input costs hurt margins.

- Fixed Income performance was ahead of the market indices losing (3.5%) versus the benchmark drawdown of (6.1%), primarily due to our cash position and the class remains solidly ahead YTD at (10.7%) versus (20.6%) for the market benchmark.

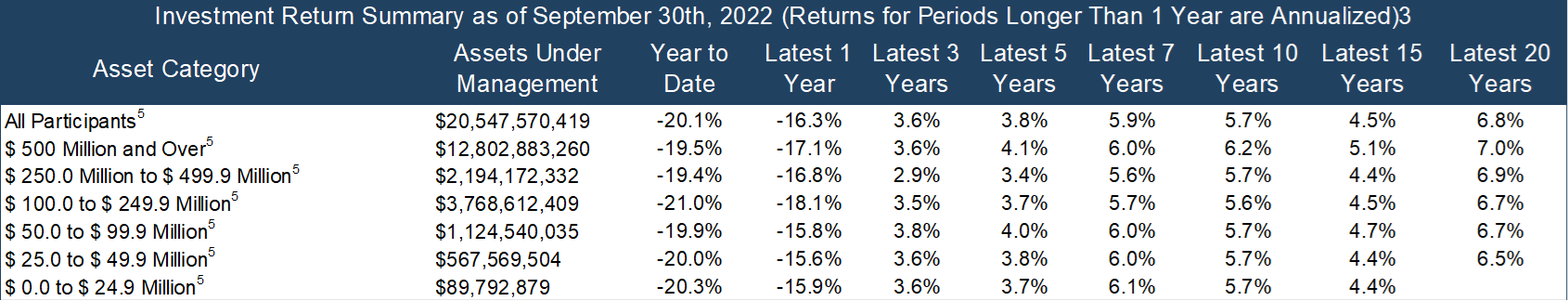

In addition to assessing results versus the market benchmark, the Foundation also assesses performance vis-à-vis its community foundation peers. Below please find the Council on Foundation’s quarterly investment performance reporting, published on 10 November 2022. The Corporation’s performance, which has been inserted below for comparison versus our peer group, which is the “$500 million and Over.” The peer group contains 20 community foundations, with a combined AUM of $12.8 billion, or an average of $640 million.

*The Corporation is a Connecticut registered investment adviser and part of The Community Foundation for Greater New Haven.

Questions? Contact A.F. Drew Alden, SVP and Chief Investment Officer, The Community Foundation for Greater New Haven; President and CEO, TCF Mission Investments Company