Liberty Bank Foundation Partners with New Haven Equitable Entrepreneurial Ecosystem

Grant Funding Supports Local Entrepreneurs and Small Businesses Owners

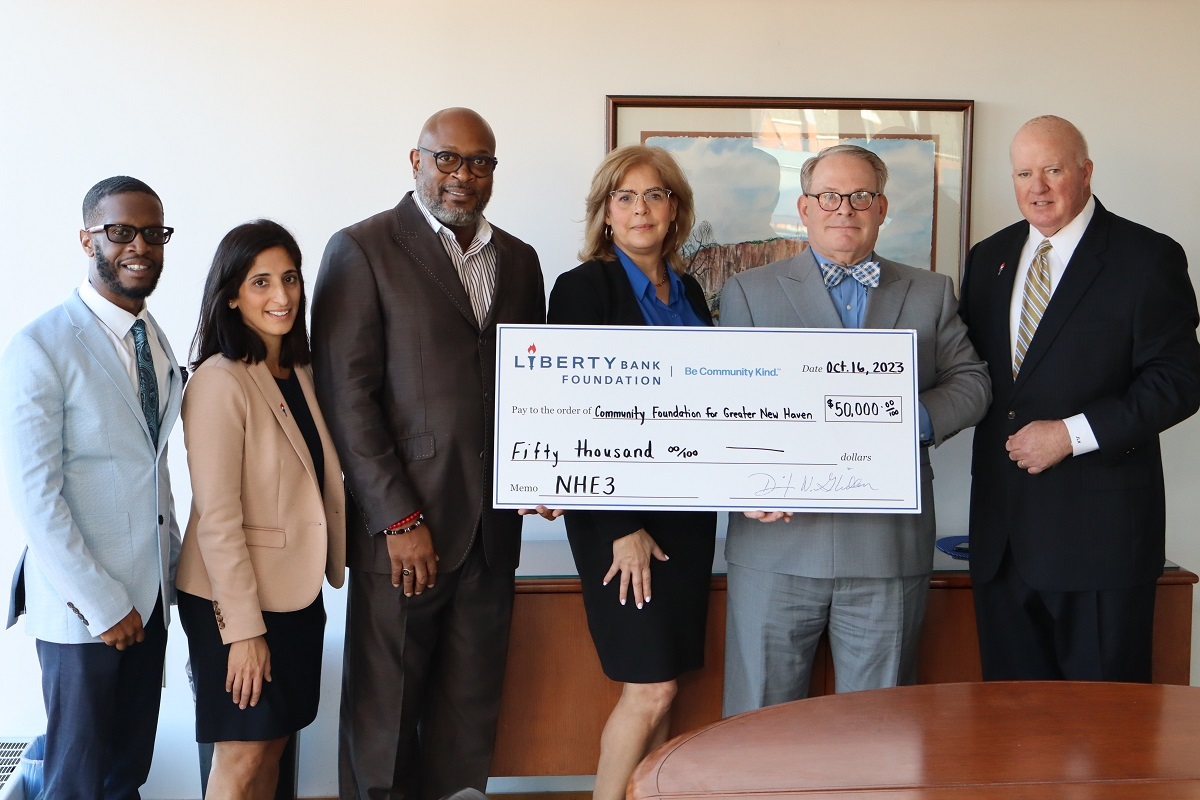

New Haven, Conn. (Oct. 19, 2023) — The Liberty Bank Foundation is helping increase new resources for Greater New Haven entrepreneurs with its second grant to the New Haven Equitable Entrepreneurial Ecosystem (NHE3). Liberty has given a total of $100,000 to the NHE3, a resource support network designed to help business owners in neighborhoods that have historically lacked investment.

“This grant from the Liberty Bank Foundation signifies the growing support for local BIPOC entrepreneurs and our vision and mission by a financial institution in the community. Through its generous contribution, Liberty is helping make the New Haven Entrepreneurial Ecosystem a more sustainable and equitable model for years to come,” said Joe Williams, Director of Equitable Entrepreneurial Ecosystems at The Community Foundation for Greater New Haven.

“At Liberty Bank, our Mission to improve the lives of our customers, teammates and communities for generations to come extends far beyond the first-class banking products and services we provide. It also means investing in forward-looking community programs like the New Haven Equitable Entrepreneurial Ecosystem that goes a very long way in boosting small business opportunities and providing resources entrepreneurs should have - ultimately strengthening neighborhoods and New Haven’s local economy,” said David W. Glidden, President & CEO of Liberty Bank and President of the Liberty Bank Foundation.

The NHE3 offers funding, including grants, and is building a support network with a range of business services through its website, e3connector.com. Over the next five years, using funding from the state Department of Economic and Community Development, the NHE3 plans to award more than 750 grants averaging $6,000 each.

The Black Corner, in New Haven, is among the several hundred small businesses that have received grants and business support through the NHE3 since its launch in 2022. Michael and Kenia Massey opened the store out of a passion for giving neighborhood kids a safe place to socialize. Michael had grown up around the corner from the store and wanted to recreate the same sense of community that he had felt there as a kid.

“It was the first store I could go to without parental supervision. Corner stores are unique, given that everybody in the neighborhood goes to the corner store,” said Michael Massey. “I figured, representation is necessary and that the kids needed someone to look up to.”

The Black Corner had to shut its doors during the pandemic and nearly closed for good. It reopened after receiving funding from several sources including the NHE3 facilitated DECD grant.

The Community Foundation Mission Investments Company launched the NHE3 as part of The Community Foundation’s overall strategy to increase opportunity and advance equity. The e3connector.com website is a portal for small business owners to apply for grants and sign up for business support services. Applicants can also be connected with Entrepreneurial Support Organizations (ESO) in the ecosystem to guide them through the application process, which includes gathering financial statements.

The Liberty Bank Foundation grant will support the continued growth of the NHE3, allowing it to reach more entrepreneurs with more resources.

“Our community needs all hands on deck to create an equitable ecosystem for BIPOC entrepreneurs and business owners. We thank the Liberty Bank Foundation for being a partner in this work and providing resources that will go toward supporting a new generation of business owners and wealth generators,” said Drew Alden, President & CEO, TCF-Mission Investments Company (TCF-MIC)

“The Liberty Bank Foundation grant supports our ability to build the economic architecture that fosters wealth creation for our BIPOC enterprises,” said Arthur Thomas, Director of Mission Investing and Entrepreneurial Ecosystems at The Community Foundation for Greater New Haven.

The Community Foundation for Greater New Haven

The Community Foundation for Greater New Haven’s mission is to inspire, support, inform, listen to and collaborate with the people and organizations of Greater New Haven to build an ever more connected, inclusive, equitable and philanthropic community. Established in 1928 The Foundation is one of the oldest and largest community foundations in the U.S and has been built by donors supporting a broad variety of issues and organizations. As the permanent charitable endowment for 20 towns in Greater New Haven, The Foundation is implementing a 5-year strategic plan to expand opportunity and equity in our region. Stepping Forward, a commitment addressing the impact of COVID-19 and advancing racial equity is also in place through 2023. For more information about The Foundation visit www.cfgnh.org

or follow @cfgnh on facebook and twitter.

Liberty Bank Foundation

Since its inception in 1997, the Liberty Bank Foundation has awarded over $17 million in grants to nonprofit organizations within Liberty Bank’s market area. The foundation seeks to improve the quality of life for people of low or moderate income by investing in three areas: education to promote economic success for children and families; affordable housing; and nonprofit capacity building. For more information on Liberty Bank and its Foundation, visit www.liberty-bank.com